We are very proud to introduce a powerful new feature, Instant Access. Made possible by Securitize’s best-in-class DS Protocol, Instant Access gives investors the ability to transact in digital securities in ways never before possible.

Instant Access allows investors to privately create an indication of interest to sell their digital securities with a simple web link. That link can be posted and shared with anyone, anytime, on any platform they prefer, including via email or text message.

There are no fees associated with using Instant Access to create or accept transfers. The only costs come from processing the transaction on the Ethereum blockchain. These costs (known as “gas costs”) are unrelated to the value of the securities being transferred. Neither Securitize nor any other party will be paid fees for these transactions.

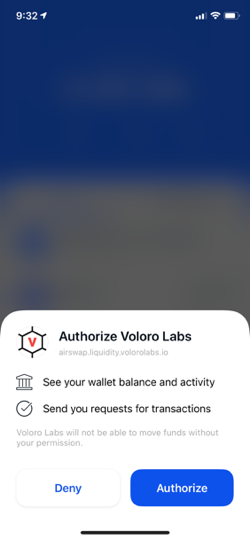

Important Note: Instant Access must be enabled by an issuer and will only be accessible on the issuer's private website, not through Securitize's website. Once an issuer decides to enable the Instant Access feature, any potential buyer who has KYC/AML approval from, and is registered with the issuer, can purchase the digital security from the holder if the holder has shared the transaction link with them. Only transactions that meet these KYC/AML requirements and adhere to any applicable transfer restrictions imposed by the issuer via the DS Protocol will be permitted.

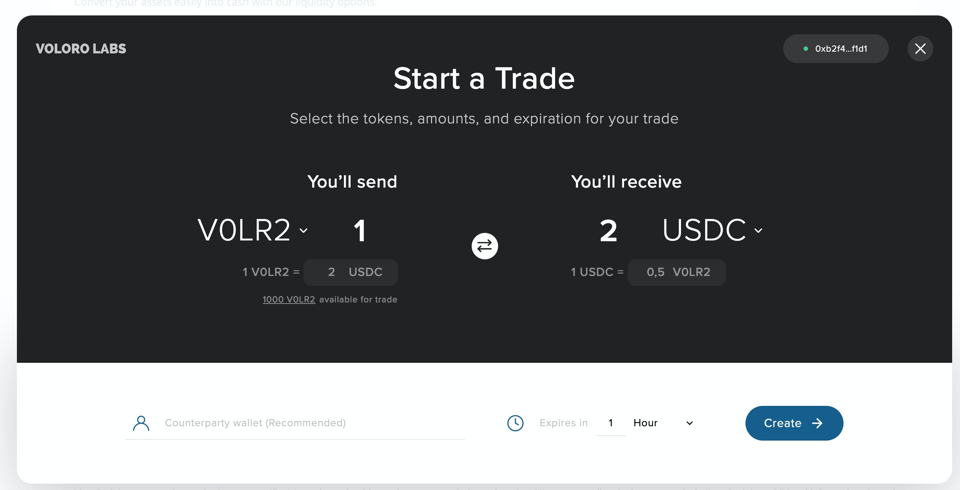

We will illustrate using a fictional company called, Voloro Labs. Imagine we have an investor, Anne, who wants to sell one V0LR2 token, which represents equity in the company Voloro Labs, for $2 to her friend, Bob.

In our example, Voloro Labs has enabled the new Instant Access feature, making it possible for Anne to initiate the transaction.

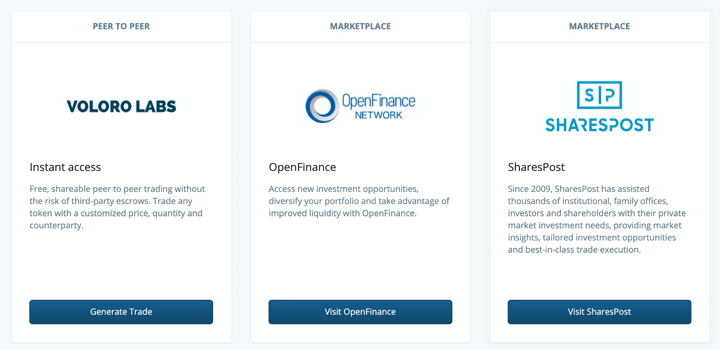

In this example, Voloro Labs has its securities listed on secondary marketplaces OpenFinance Network, and SharesPost, which are also visible on Anne’s dashboard.

Instant Access solves the counter-party risk on personal peer-to-peer transactions of securities by ensuring that when a trade is arranged between a seller and the buyer, the buyer cannot receive the securities without paying the corresponding amount to the seller.

This is known as an atomic swap in blockchain terminology and it ensures that both tokens — the one representing the underlying securities and the one representing the corresponding payment (e.g., a stable coin like USDC or DAI) — complete the transaction or that the transaction does not happen at all.

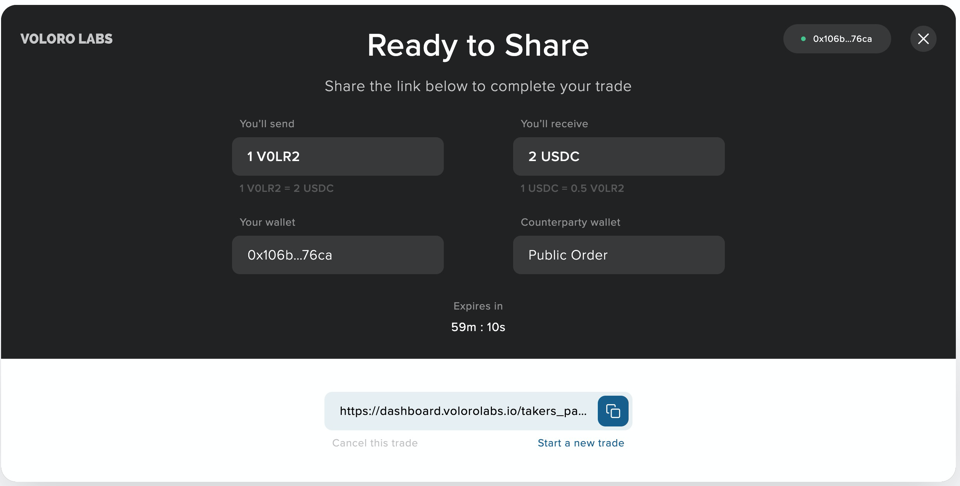

This new tool solves this issue by allowing an investor to indicate their interest to sell their digital securities in the form of a web link. This web link can be shared with the person they want to do the trade with by any means available, like sending an email, using a text message, or simply “Airdropping” the URL to the other person’s phone.

Securitize’s DS Protocol will ensure that the trade complies with relevant laws, while the atomic swap smart contract guarantees that the exchange is produced in an indivisible way. Thanks to this technology, It is not possible for the buyer to not receive the tokens nor is it possible for the seller to not receive its consideration for the transfer.

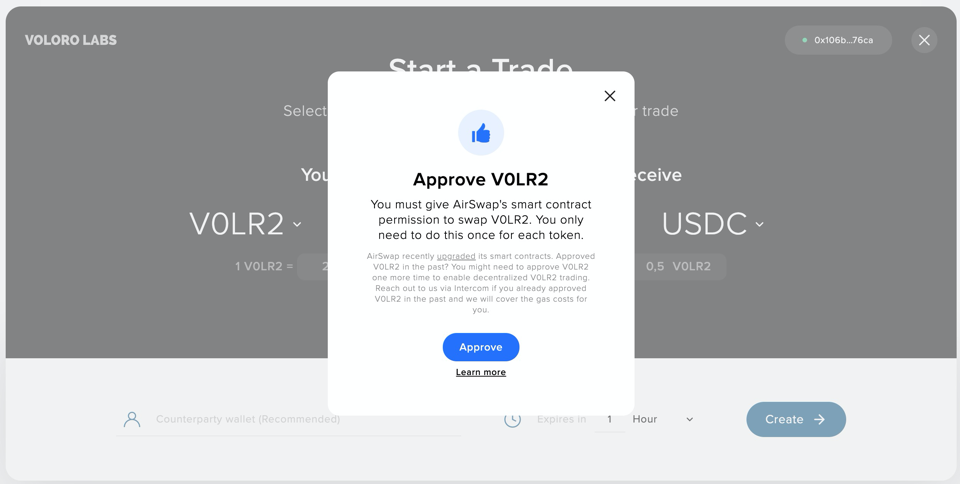

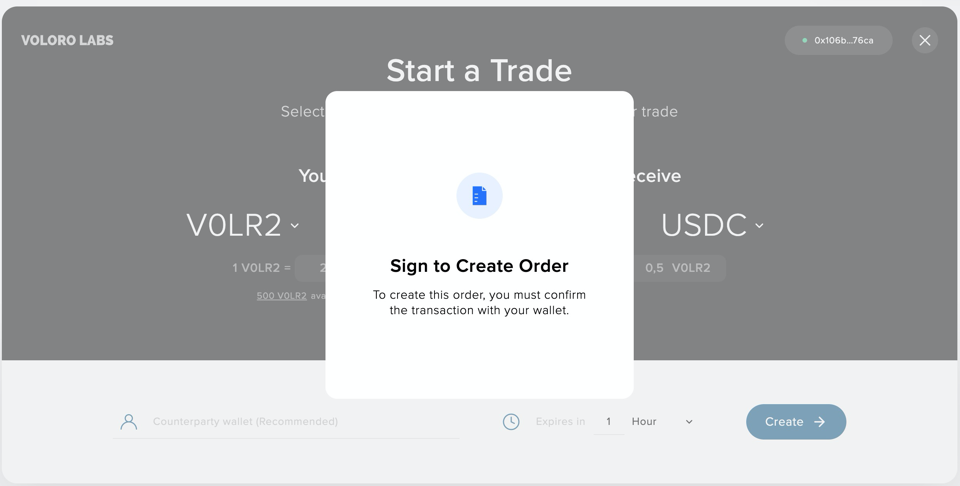

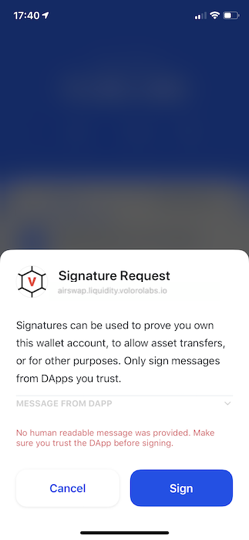

Here is how our investor, Anne, will create and execute the transfer of one V0LR2 token to (Bob) in exchange for two $2USD:

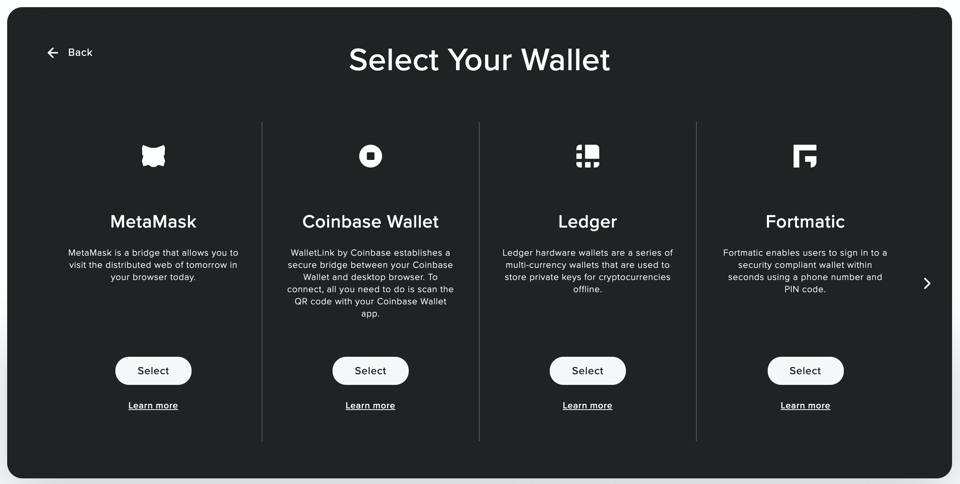

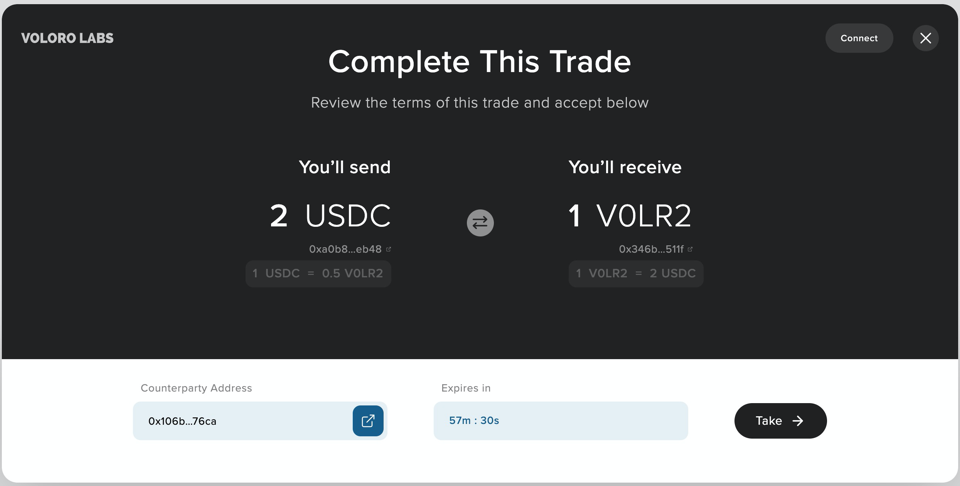

Bob receives the link via WhatsApp, and can access it to review the trade details and choose whether to take it.

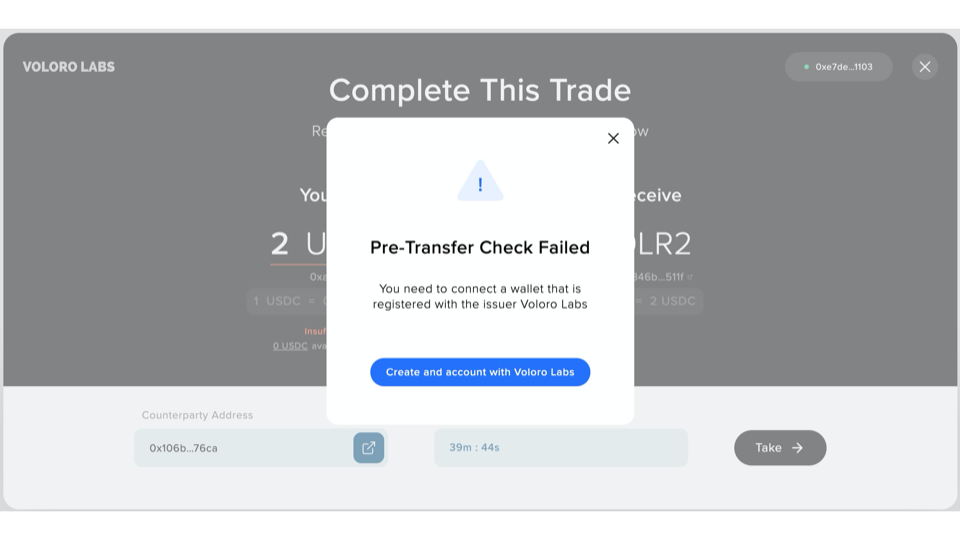

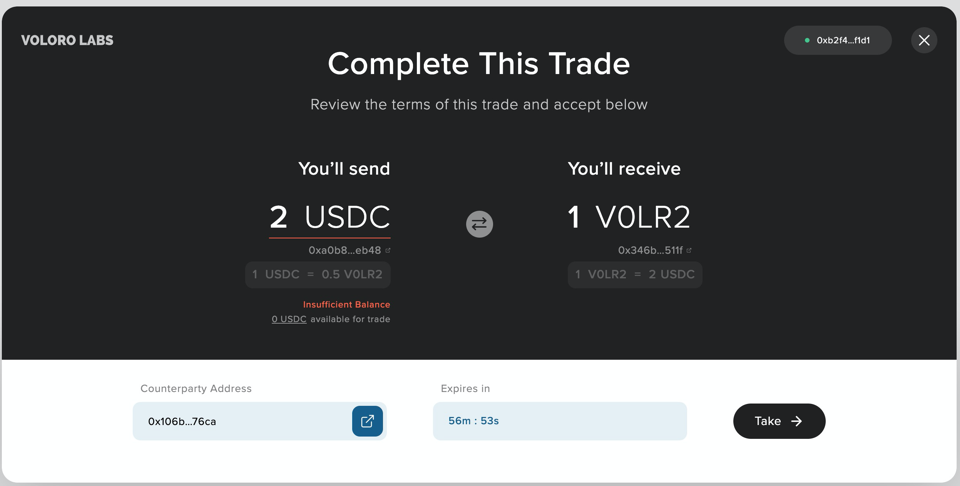

But in order to accept it some conditions must apply:

But in our example, all these conditions are met, and Bob can also sign his side of the order (in the same way Anne did it before, with any of the approved wallets) which will execute the transfer.

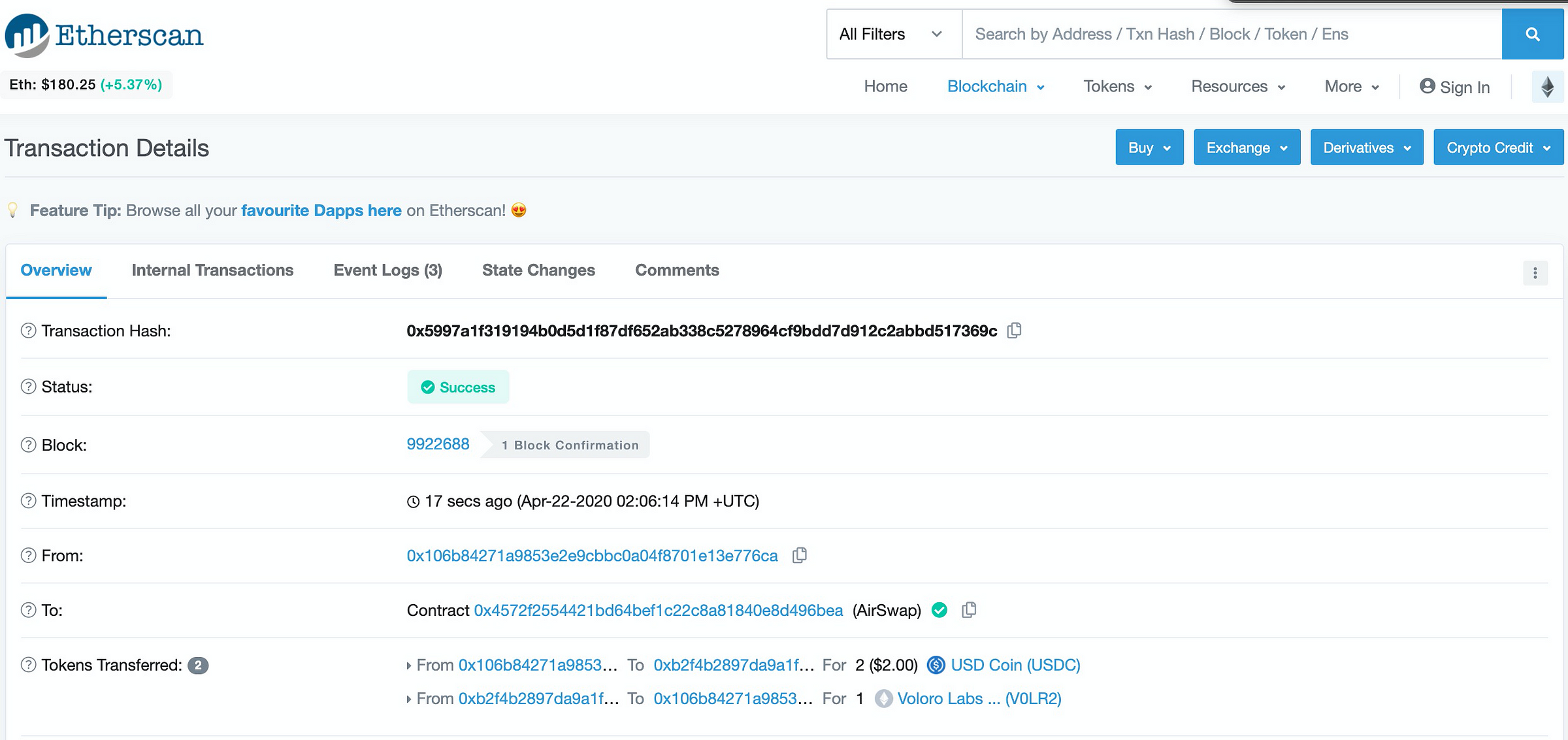

The transfer is processed by the Ethereum blockchain and can be verified in a block explorer that will reflect how both assets have been exchanged in a single transaction. This is how this transaction looks in Etherscan:

We can see how the 2 USDC and 1 V0LR2 token moved in opposite directions in an atomic way.

The security and ease of use of Instant Access to trade digital securities brings new liquidity options to issuers and their investors without compromising safety, security, and compliance. Instant Access is just the latest tool made possible by digital securities and Securitize’s DS Protocol. We look forward to hearing feedback and improving this new feature as we continue to develop powerful solutions for digital securities.

当サイトは株式会社Securitize (以下「Securitize」といいます) が運営しており、登録証券会社ではありません。Securitizeは、デジタル証券に関する投資アドバイス、保証、分析、推薦を行うものではありません。Securitize の技術によって提供されるすべてのデジタル証券は、該当するデジタル証券の発行者によって提供されており、それに関連するすべての情報は、該当する発行者が責任を負うものとします。Securitizeおよびその役員、取締役、代理人および従業員のいずれも、Securitizeの技術を利用したデジタル証券について、いかなる推奨または保証を行うものではありません。本ウェブサイトのいかなる内容も、デジタル証券の提供、配布または勧誘と解釈されるべきではありません。Securitizeは、Securitizeの技術を利用したデジタル証券に関連して、カストディサービスを提供するものではありません。